Whereas in partnership the chargeable income is divided among the partners as an individual. A PAN card for the proprietor.

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

You will receive a letter from the tax authority the CP500 informing you of the amount of taxes which you need to pay.

. 20 lakhs it must register under the GST. Difference is they are required to declare the business income. Please select one of these options.

Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc. A sole proprietorship is the most common and simplest legal business structure in Malaysia. Prime Minister Muhyiddin Yassin declared during a live telecast on 5 June 2020 that the government will introduce a new short-term economic stimulus programme called PENJANA.

Claim up to RM 20000 in Income Tax Rebate from PENJANA. 9 rows Sole Proprietorships. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual.

Sole proprietorship From the tax perspective there is no separation between you as an individual and you as a sole proprietor. SOLE PROPRIETORSHIP Personal Name. The sole proprietorship in Malaysia is governed by the Registration of Businesses Act 1956.

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. For Sole Proprietorship a checklist is necessary. If you are a sole proprietor use the information in the chart below to help.

Does sole proprietor need to pay tax. The businesss name and address. A bank account opened in the businesss name.

In the case of sole proprietorship business chargeable income is his or her individual income. ROBA 1956 and Registration of Businesses Rules 1957 is a type of sole proprietorship and partnership business. Registration under the Shop and Establishment Act of the relevant state.

A sole proprietor is someone who owns an unincorporated business by himself or herself. A sole proprietorship is the simplest and most popular type of business to establish. Does sole proprietor need to pay tax.

A lone proprietor is a business owner who is responsible for all aspects of the operation of their own company. A sole proprietorship is held entirely by a single person who uses their personal name identity card or trade name. These benefits of starting a sole proprietorship business in Malaysia are quick and easy registration no corporate tax payments lowest manual maintenance less formal business requirements easy winding process and more.

Whatever you pay yourself either in the form of remuneration allowances or benefits such amounts are not tax deductible in arriving at the statutory income from the sole proprietary business. Unique features of a Sole Proprietorship like fast and easy registration no corporate tax. A sole proprietorship is a wholly owned business by a single individual using his personal name or a trade name.

MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia. In Malaysia the tax authority collect taxes from sole proprietorship and partnerships upfront. 17-2 Dinasti Sentral Jalan Kuchai Maju 18 Off Jalan Kuchai Lama 58200 Kuala Lumpur Wilayah Persekutuan Kuala Lumpur.

Lets assume that Janet switches her sole proprietorship to JM in 2020. The upfront tax estimate will be payable bi-monthly in 6 instalments. Within All Malaysia Government Websites.

Sole Proprietorship registration is the most common and simplest legal business structure option in Malaysia. If the companys annual revenue reaches Rs. Sole proprietors file fewer tax forms and spend less in startup costs than other types of enterprises.

Yes they are still liable to file their personal tax filing annually. It is governed by Companies Commission of Malaysia abbreviated SSM Suruhanjaya Syarikat Malaysia and Registration of Businesses Act 1956. In Malaysia a.

A single owner is regarded as the same legal. Sole Proprietorship is governed by Companies Commission of Malaysia Suruhanjaya Syarikat Malaysia and Registration of Businesses Act 1956. Banjaran Pendapatan Cukai Pengiraan RM Kadar Cukai RM.

Company Formation In Switzerland Corporate Bank Public Limited Company Switzerland

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Benefits Of Bookkeeping Infographic Ageras Bookkeeping Bookkeeping Business Bookkeeping And Accounting

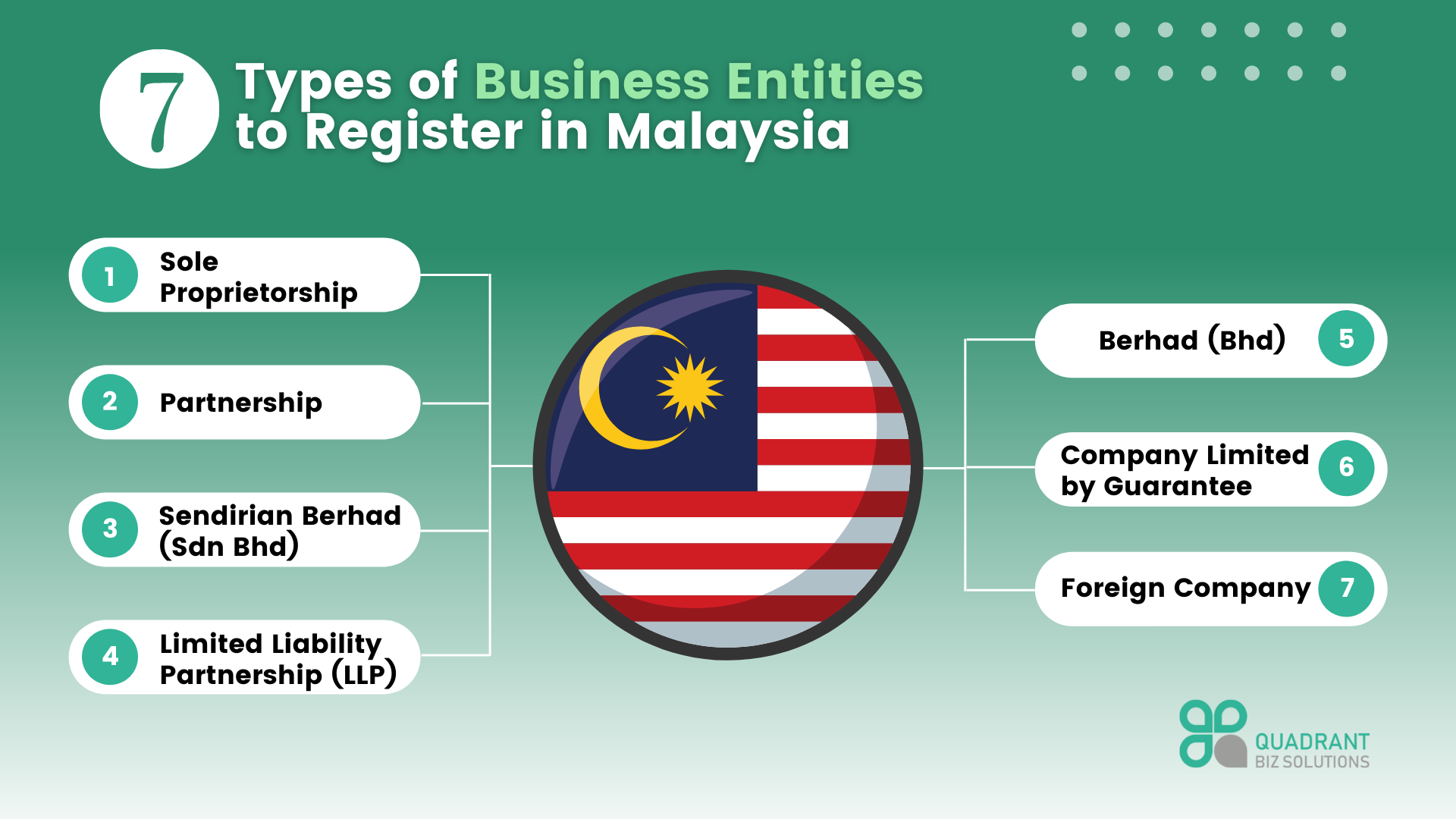

6 Types Of Business Entities In Malaysia Tetra Consultants

Company Secretary Bangladesh Company Registration Process In Usa Company Secretary Consulting Firms Kong Company

Understanding Business Entities In Malaysia Quadrant Biz Solutions

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Faq Company Registration In Bangladesh Business Starting A Business Services Business

A Guide To Sole Proprietorship Taxes Smartasset

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Legal Steps For The New Company Incorporation In India Corpbiz Private Limited Company Limited Liability Partnership Aadhar Card

Accounting Malaysia Importance Of Financial Statement By Beyondcorp Financial Statement Accounting Financial

Types Of Visa In Malaysia Malaysia Small Business Ideas Visa

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net